Do you also feel like you have no clue where your money disappears by the end of the month? Do you have a habit of spending on things you don’t really require and then regret it later? Or do you want to save up for some special projects or milestones in life? Whatever be the case, a bullet journal finance layout is your answer.

A bullet journal finance layout (expense tracker bullet journal) is a great way to track your income, expenses, savings, and plan your budget. By doing so, you will be able to attain your financial goals and make better financial decisions in life.

We have come up with a compilation of bullet journal bill trackers, budget trackers and savings log to help you through this journey.

Bullet Journal Bill Tracker

Quick question- How much did you spend last month? No clue? Don’t worry, we’ve got your back. This is precisely why you need to maintain a bill tracker or a spending log.

An expense tracker will help you gain better insight into your spending habits. It’ll help you track your expenses so that you know exactly where all your money goes. It also helps you control any impulsive purchases. By tracking and controlling your spending habits, you’ll also be able to save more to attain your financial goals.

Convinced about the need to maintain an expense tracker? Here are a few bullet journal bill tracker ideas and layouts that you can take inspiration from to create one for yourself.

1. Honey Bee Themed Monthly Bill Tracker

Here is a cute honey bee themed monthly bills and account balance tracker. I absolutely love the minimalist and functional approach of this bullet journal tracker spread. On the first page, you have a simple monthly bill tracker with the days of the month neatly numbered.

All you have to do is write down how much you spent and on what each day. The next page shows your balances. Note down your debit and credit balances to get a clear picture of your account balances and spending habits. Use stickers to give a cute look to this otherwise basic spread.

2. Summer And Beach Inspired Monthly Expense Tracker

Here is another monthly bullet journal bill tracker. I absolutely love the beach theme and the pastel colors used. Unline the previous expense tracker on the list, this one requires you to write down your spendings every week rather than every single day. It is very systematic and has separate columns for you to write down the description and amount as well. By writing down clear descriptions of your spending, you’ll be able to notice a trend or pattern in your spendings and limit your purchases accordingly. It enables you to make better financial decisions as well.

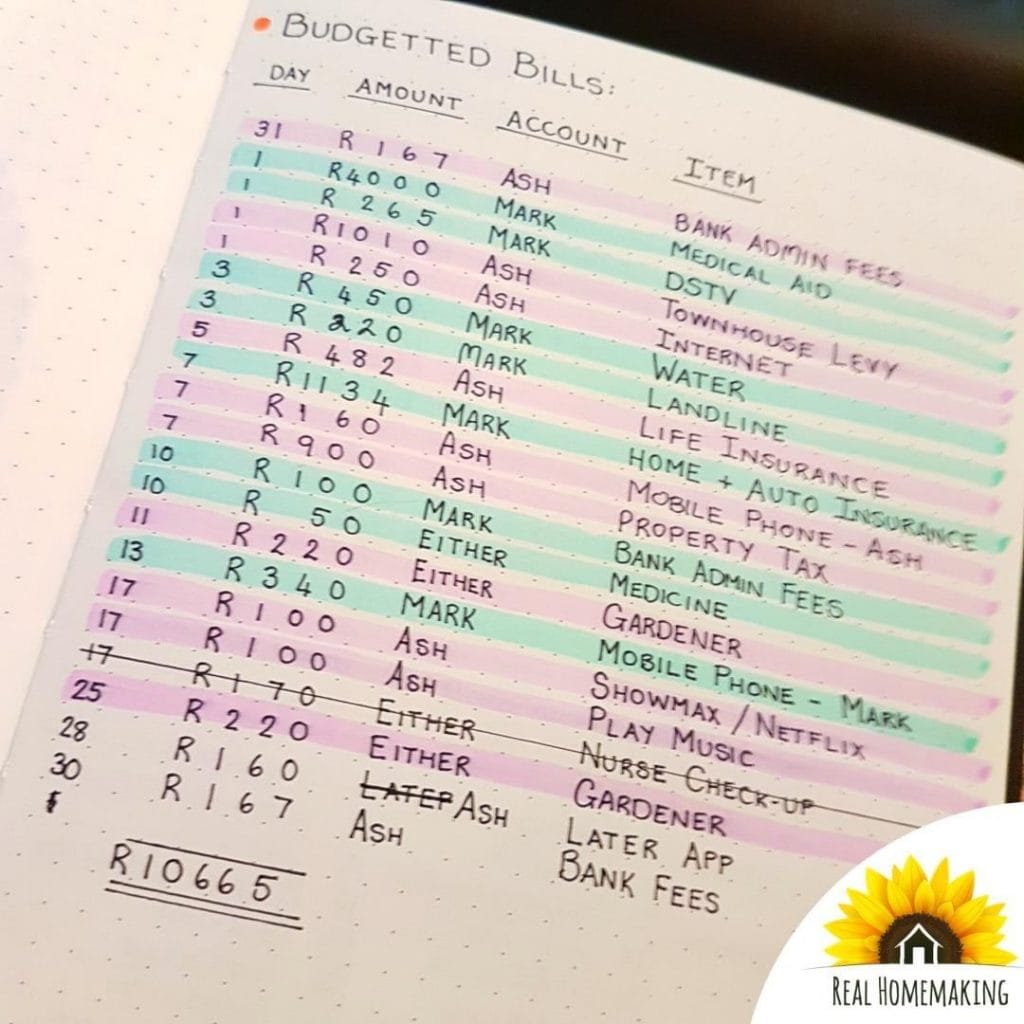

3. Monthly Bill Tracker For Couples And Families

If you want to track not only your personal expenses but also the expenses of your spouse or family, then this monthly expense tracker layout is perfect for you. With this layout, you can share the expenses with your partner and also track who paid for what. This avoids any ambiguity in payments and also ensures timely payments of your recurring expenses. Use a highlighter to indicate who paid what.

4. Space Themed Expense Tracker

Here is a space themed bullet journal spending log. This follows a simple, easy to maintain layout with just four columns. You can write the date, description, and the amount gained or spent. I also really like the font used in this tracker.

To create more such amazing fonts, refer- 20 Best Bullet Jornal Fonts For Your Bujo Pages

5. The ‘Spend On What You Need’ Spending Log

This bullet journal spending log highlights the importance of spending on what you need. The spending log is spread over two pages. On the first page, you can categorize and record your expenses according to whether they are monthly commitments, personal expenses, or charges relating to road and parking. On the next page, you have a simple log where you can record the budget and actual amount spent.

6. Artsy Bullet Journal Expense Tracker

Here is a colorful and artsy bullet journal finance tracker. This follows a simple ledger format where you write all your debit transactions on the left and credit transactions on the write side of the account. It also has a tiny savings section at the end of the page where you can record your monthly savings.

7. Organized Monthly Bullet Journal Expense Tracker

What I like most about this layout is that it has specific categories so that you can track where exactly your money goes. There are different sections where you can note down your income, credit card spends, and expenses incurred in purchasing clothes, food, and other stuff. At the end, you can total these amounts to get your total spend for the month.

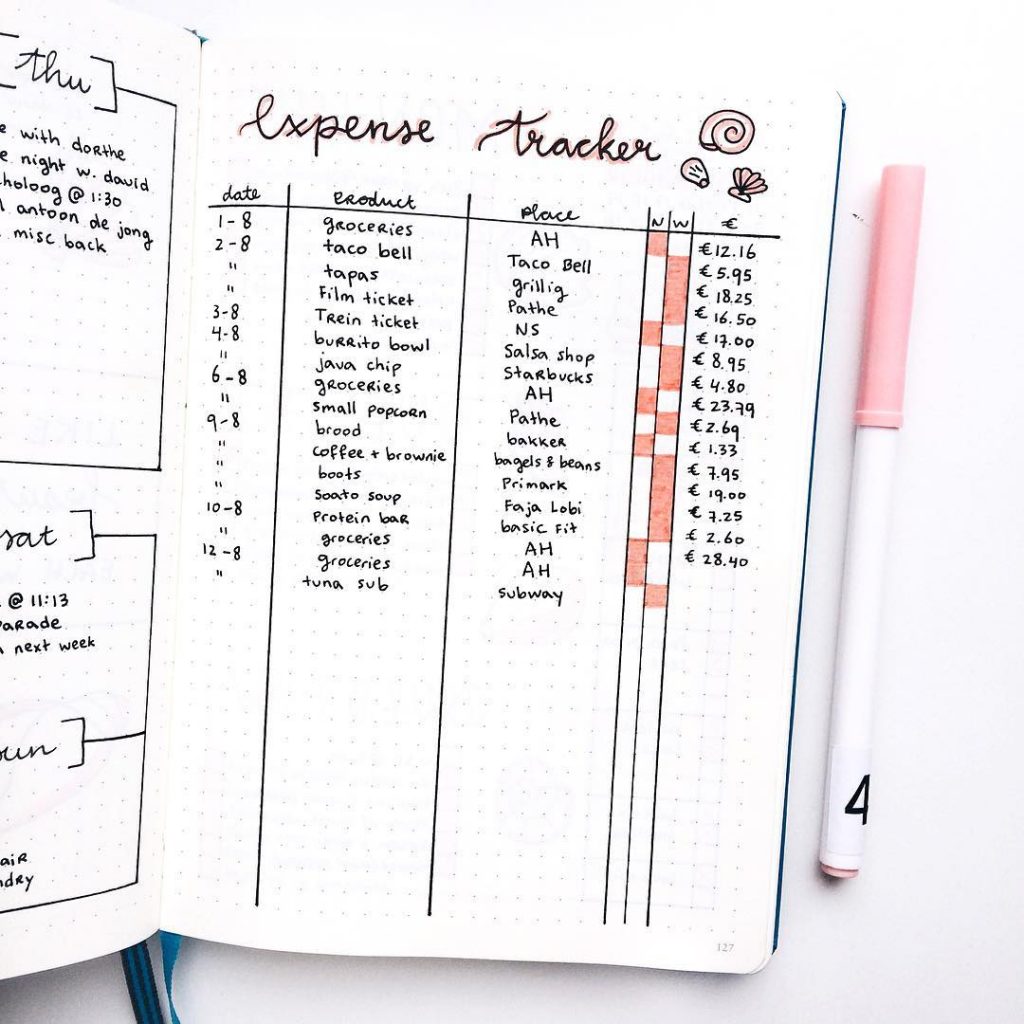

8. Need And Want Bullet Journal Expense Tracker

It is always important to distinguish between your needs and wants so that you can control your spending accordingly. This bullet journal spending log layout helps you do exactly that. Apart from the normal monthly layouts where you can write down the date of purchase, item, and amount, this layout also has two narrow columns labeled N and W for needs and wants respectively. So every time you make a purchase, you can segregate it based on whether the purchase was out of necessity or out of pure impulse. By getting a visual representation of your needs and wants, you’ll be able to make healthier financial decisions.

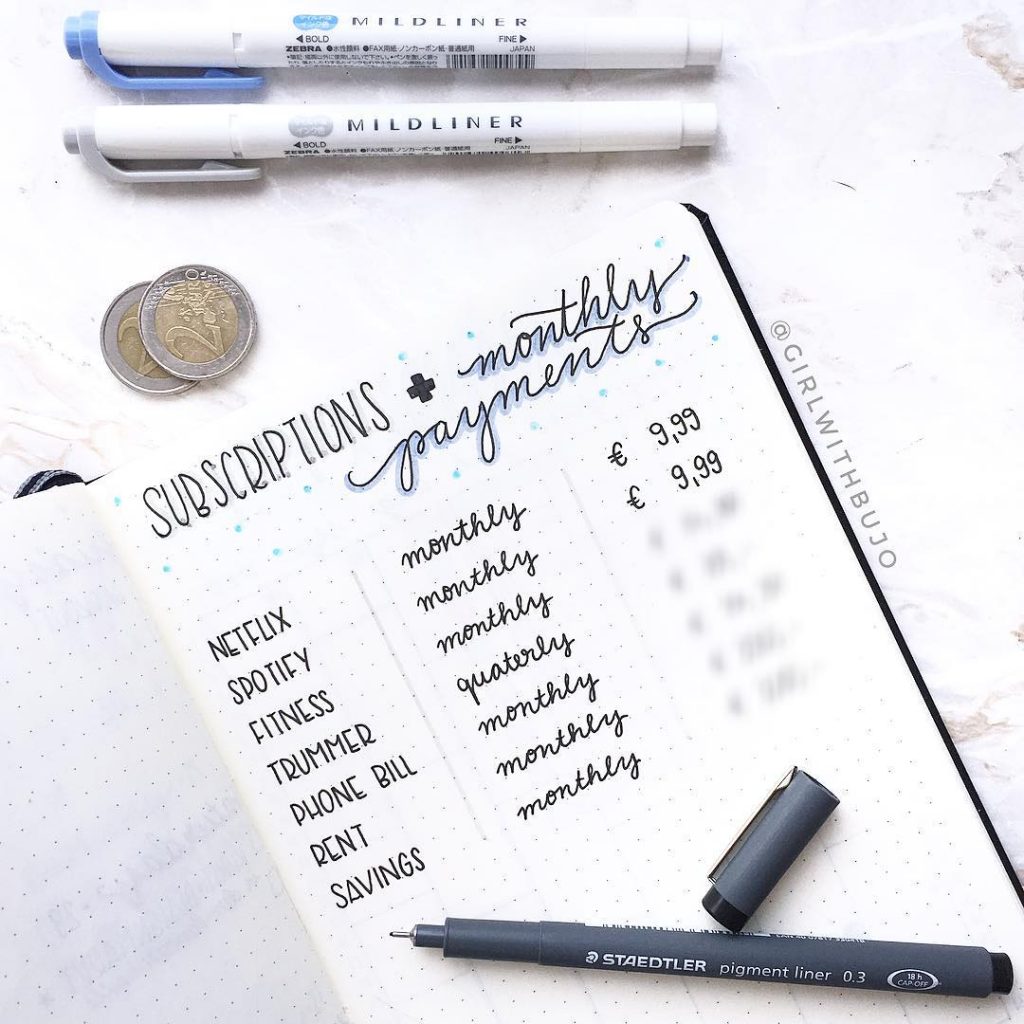

9. Subscriptions + Monthly Payments Bullet Journal Page

Here is a subscriptions and monthly payments page. Unlike other bill trackers where you track all your monthly spending, this page is specifically for your subscriptions and your fixed monthly recurring payments. Here, you can write down your payments made for your Netflix and Spotify subscription or your gym membership or recurring payments like your rent and phone bills.

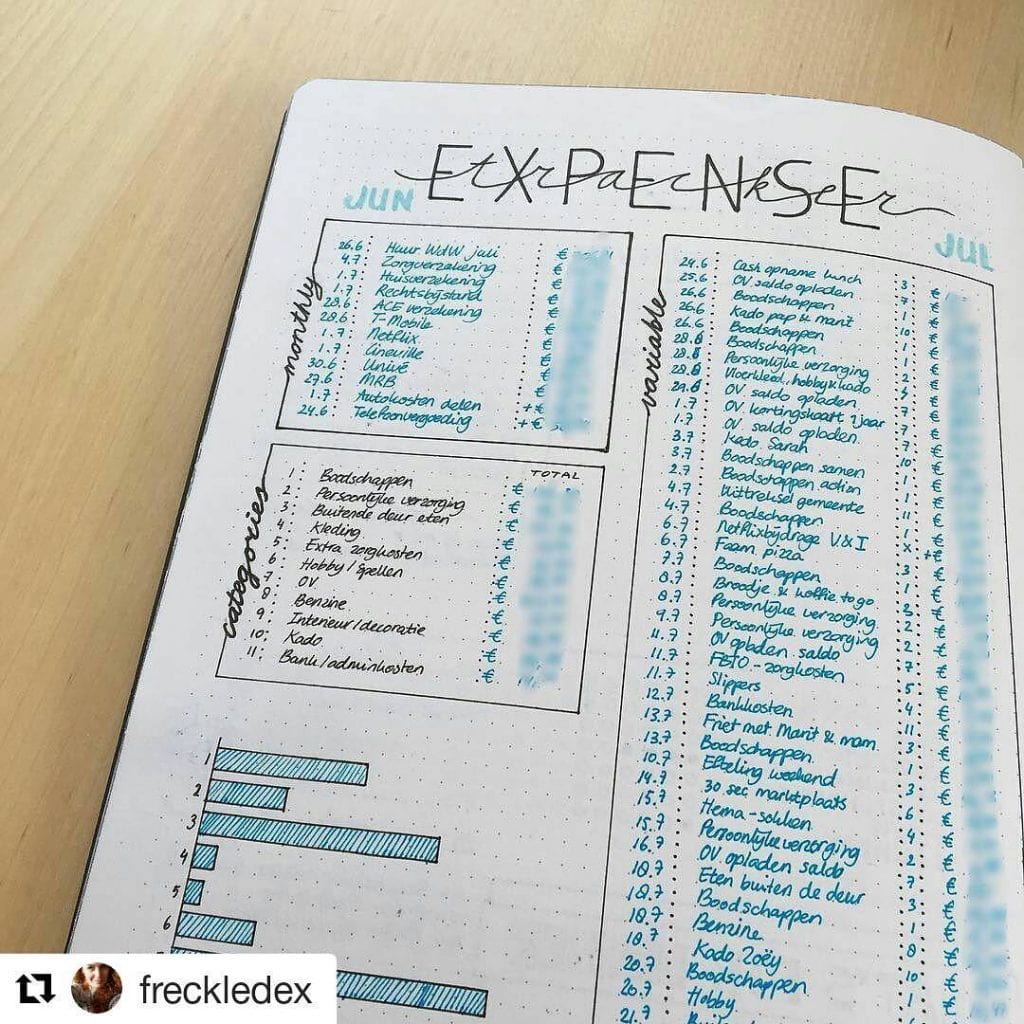

10. Detailed Monthly Finance Log Bullet Journal

Here is a detailed bullet journal expense log. Apart from recording the daily spending, you also have a section where you can note down the total spends according to different categories. I love the fact that you can also get a visual representation of the amount spent on different categories from the graph made at the bottom of the page.

11. Bullet Journal Budget And Bill Tracker

Here is a bills and budget tracker. On the first page, you can record your minimum, maximum, and average monthly budget and bills. On the next page, you can have a detailed bill tracker where you record the actual amount spent on different categories.

Bullet Journal Budget Tracker

Take your financial planning to the next level by creating a bullet journal budget tracker. In addition to tracking your expenses, in a budget tracker, you can also list down your income and expected spending or budget.

At the end of the month, you can compare your expected spendings and income to the actual values and strive to correct any deviances. This way, you can plan your finances better and make better financial decisions.

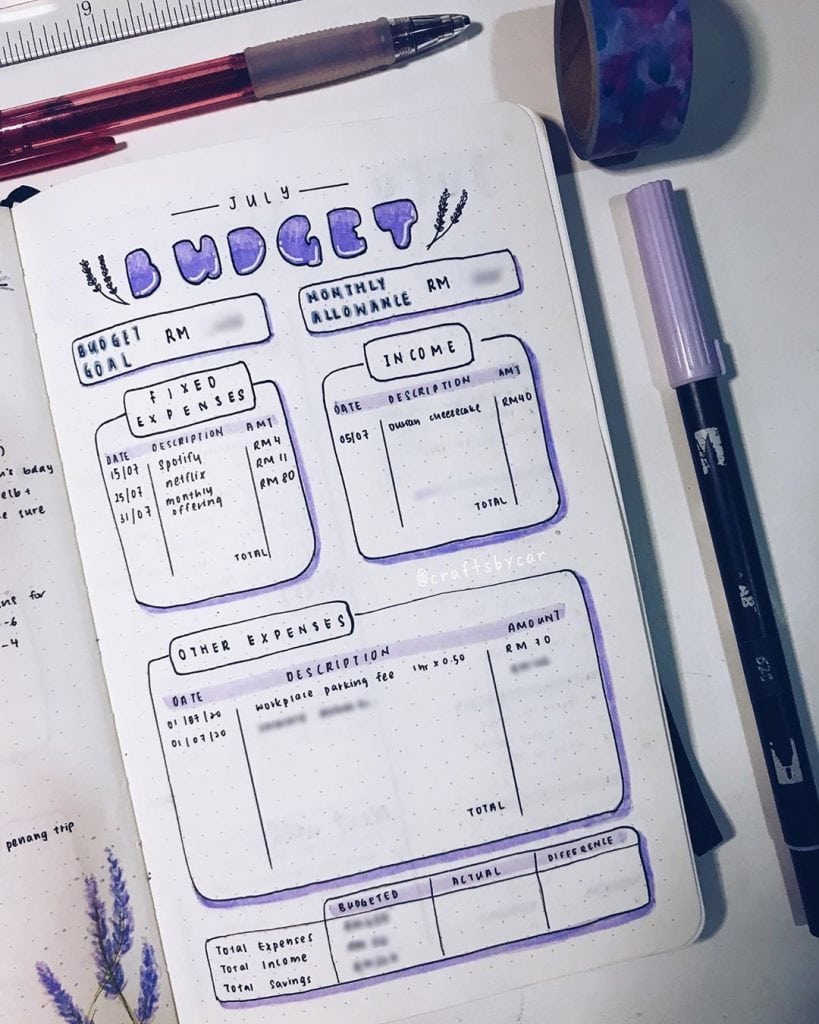

12. Simple Monthly Bullet Journal Budget Tracker

Here is a monthly budget tracker. At the top of the page, you can note down the monthly budget and allowance. Then, you can record all your expenses like how you would do in the case of a bill tracker. I love the fact that the expenses are categorized into fixed expenses and other expenses . You can also record your income. At the end of the month, you can compare your budget income and expenses to the actual amounts to find out the difference.

13. Happy And Cheerful Monthly Budget

Who says that budgeting has to be boring? You can make it a fun task by adding cute doodles and stickers to your budget tracker page. Here is a bright and colorful budget tracker. Here, you can record your monthly income, bills, savings, and miscellaneous expenses.

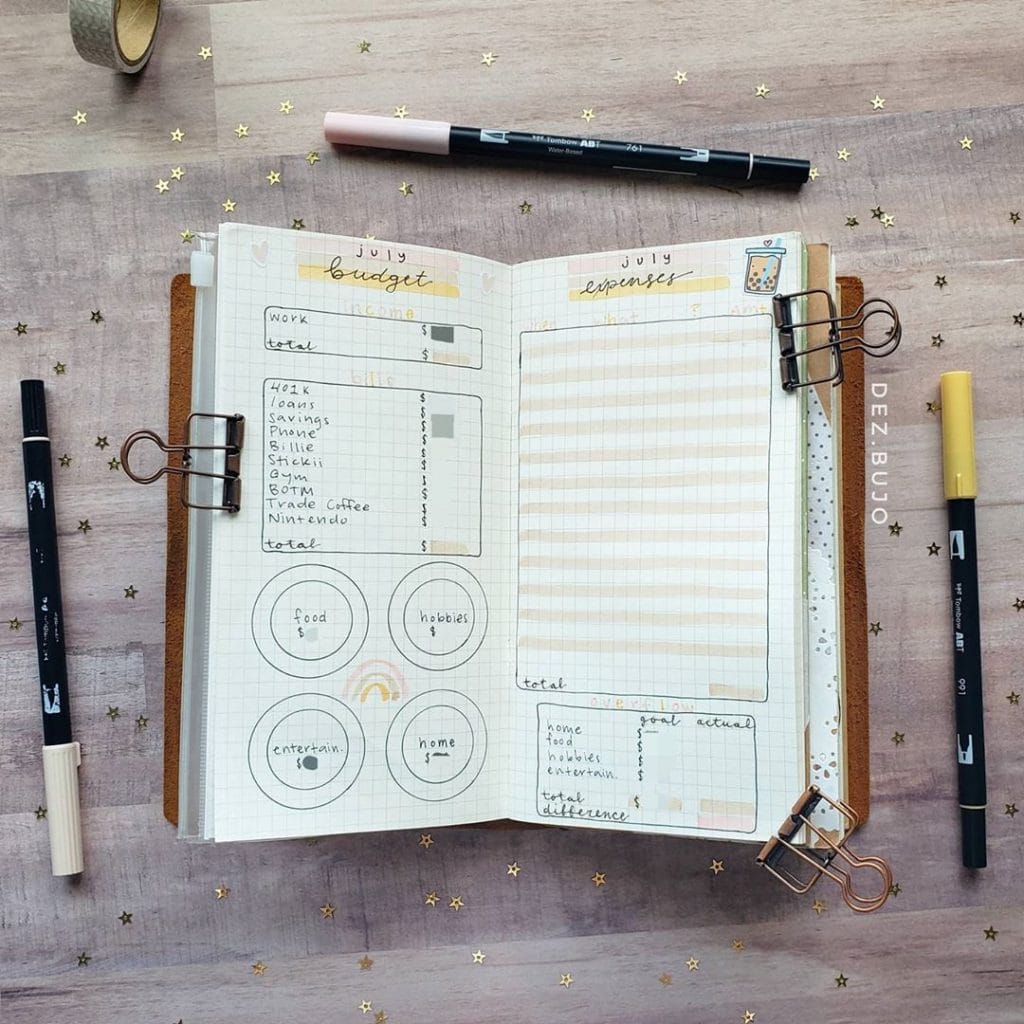

14. Spacious 2 Page Bullet Journal Budget Tracker

Here is a spacious and lavish bullet journal budget tracker. You can dedicate two pages of your journal to plan out your budget, income, expenses, debt, and savings.

15. Bullet Journal Budget Log With Spending Tracker

Here is a budget log along with spending tracker. Being a foodie, I love the food themed bullet journal spread. In the budget log, you can plan out the amount you intend on spending on various categories such as groceries, eating out, kids, home, etc. You can also calculate your expended savings. You can match your expected expenses and savings with the actual amount by creating an expense tracker on the next page. This spread also has a running log and a reflection section as well.

16. Minimalist Monthly Bullet Journal Budget Log

Here is a minimalist budget tracker. On the first page, you can plan and map out your expected incomes, expenses, and savings, or in other words, your budget. On the next page, you can track your expenses and bills to get an estimate of your actual spending. Compare your goal amount with the actual amount to get the difference in value. I love the fact that you get a visual representation of your spending habits by looking at the minimalist graph on the first page.

17. Mountain Themed Bullet Journal Budget Tracker

Here is a cute, mountain themed bullet journal savings tracker. This is a simple tracker where you can track your income and expenses to compare them at the end and get your balances. But instead of totaling your amounts at the end of the month, this layout allows you to keep tabs on how much you have spent at the end of each week. This way, you will be able to plan and control your expenses for the subsequent week accordingly.

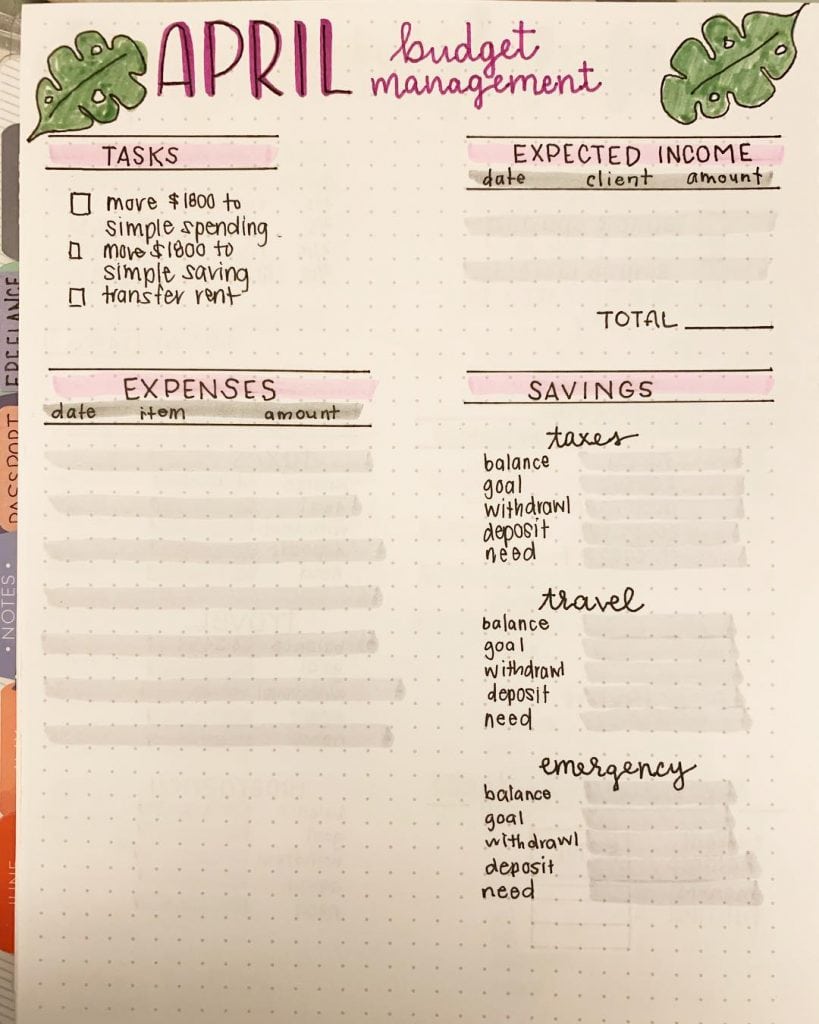

18. Bullet Journal Budget Management Page

Here is a bullet journal budget management page. You can list down your tasks, expected income, expenses, and savings. One feature that I find really helpful about this layout is that you can categorize your savings according to what you want to save for. For example, here you can save for your taxes, travel, and emergency. By knowing what exactly you are saving for, it will give you an extra incentive to save more and reach your financial goals.

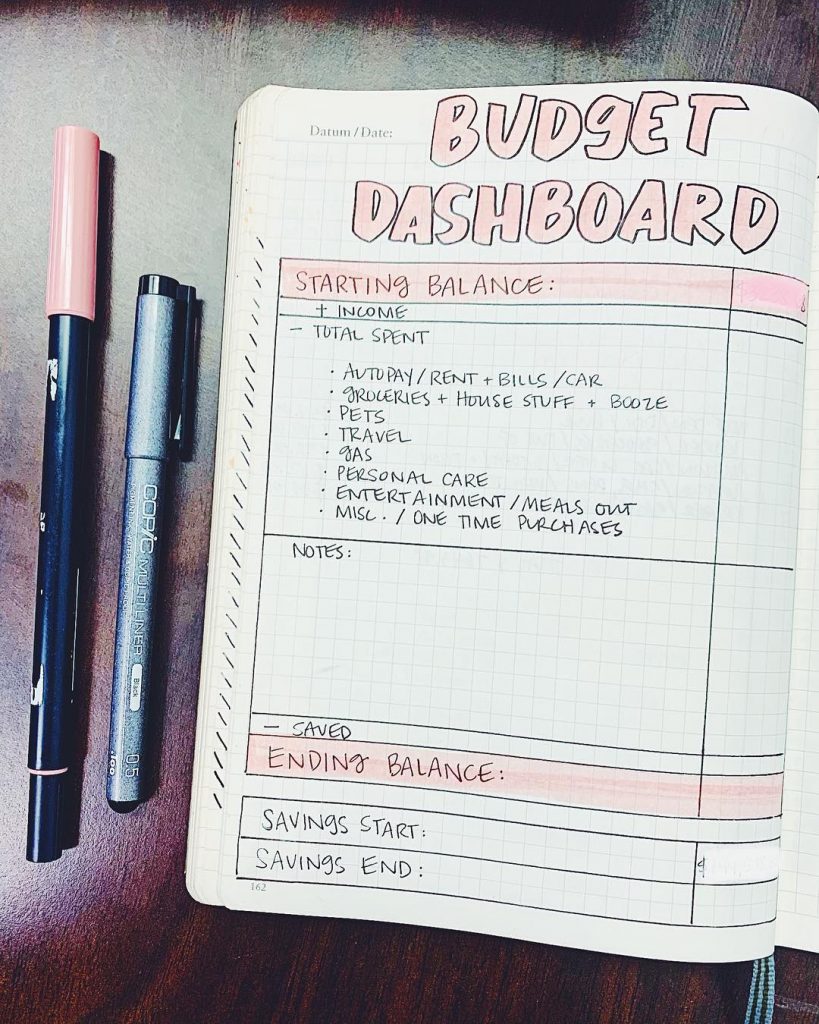

19. Simple Bullet Journal Savings Tracker

Here is a simple and easy to maintain bullet journal budget dashboard. All you have to do is start the page with your starting balance at the beginning of the month. Add any income and subtract all expenses from it. You also need to subtract any amount set aside as savings. Once you use this basic formula, you can arrive at your balance at the end of the month. You can also track your savings by comparing the savings at the start and end of the month.

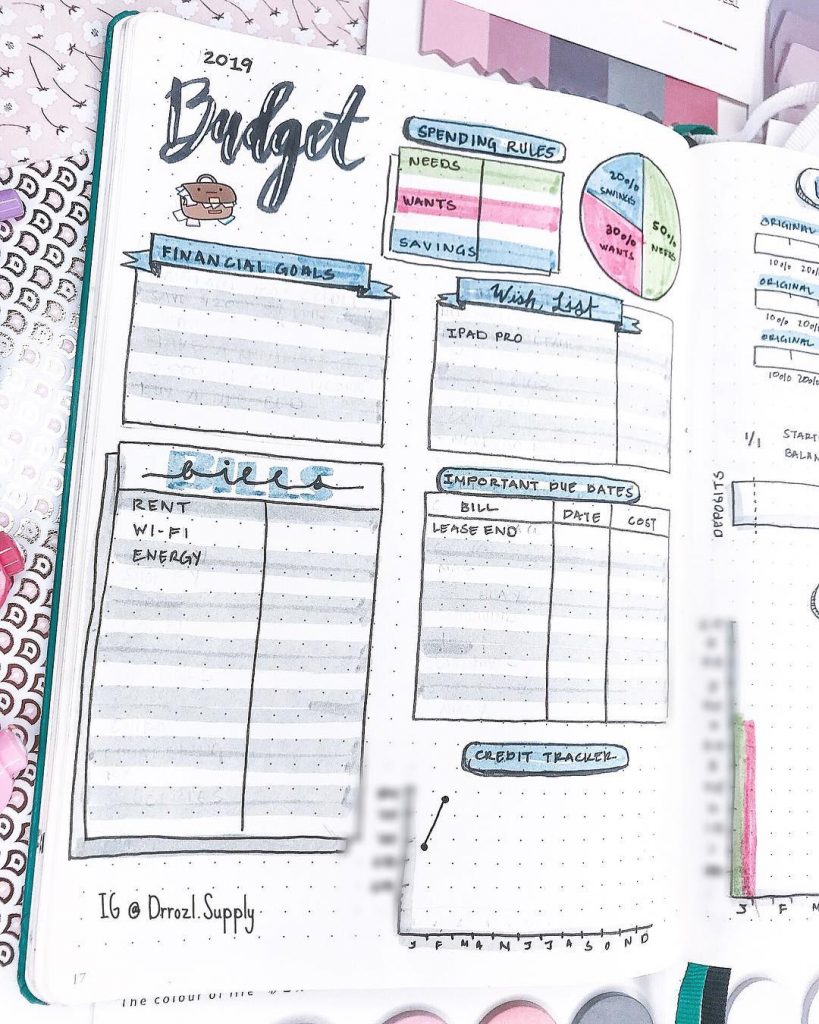

20 .Detailed Bullet Journal Budgeting Page

Here is a detailed bullet journal budget tracker. At the very top of the page, you have a small section titled spending rules. Here, you can allocate your budget for your needs, wants, and savings. You can also represent it in a pie chart to get a visual representation of your budget. In this layout, you also have sections to write down your financial goals and wishlist. This way you will be more accountable to your financial goals. You can also track your bills, expenses, credit, and important payment due dates.

Bullet Journal Savings Tracker

Setting aside some amount of money each month from your income is a good practice to save up for your financial goals. You may want to save up to buy a car, or to go on your dream vacation, or simply to meet any emergencies and contingencies. Maintaining a savings tracker will provide you with a visual cue that will motivate you to save more.

Here are a few bullet journal savings tracker to help you track your savings.

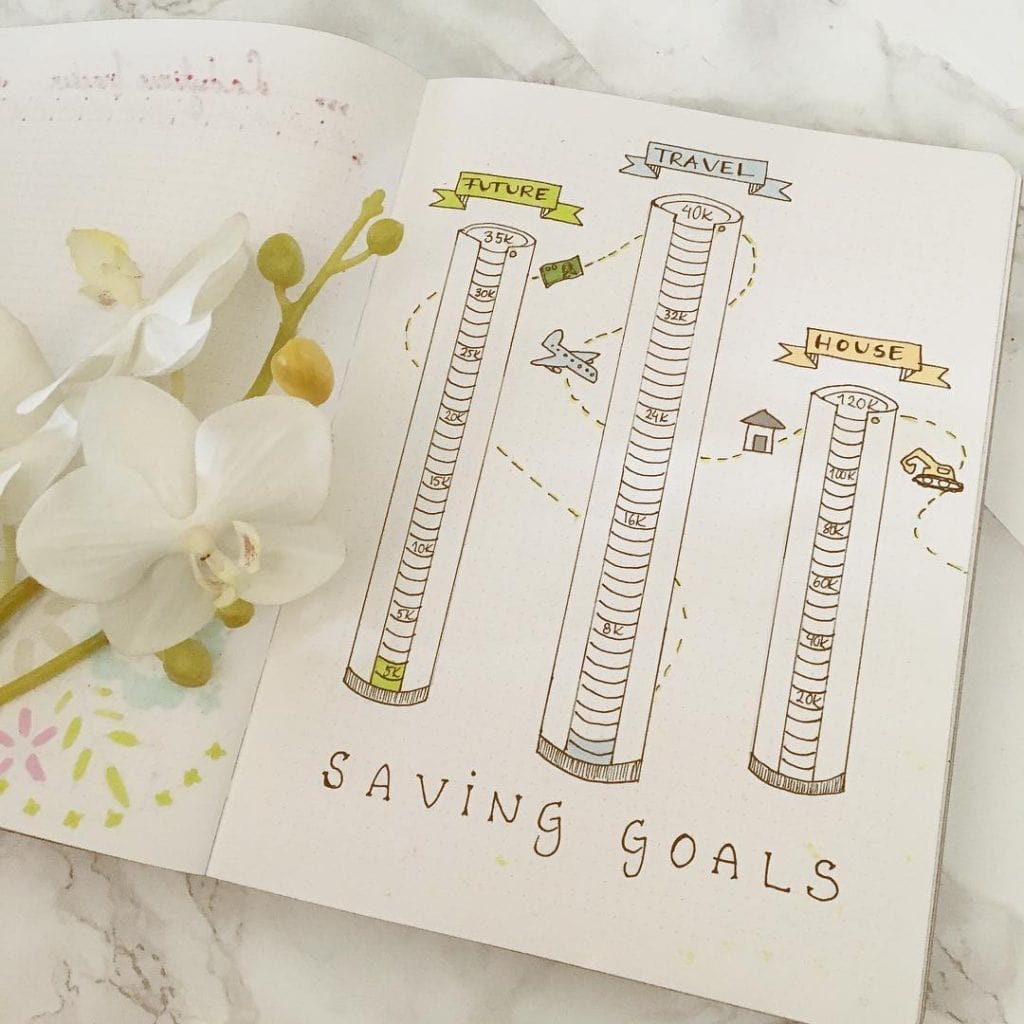

21. Bullet Journal Saving Goals Page

Here is a bullet journal saving goals page. This layout allows you to get a visual representation of your savings while clearly demarcating what you are saving for. These are coins stacked together and at each regular interval, you have a saving goal assigned. All you have to do is color the coins until you have reached your goal amount.

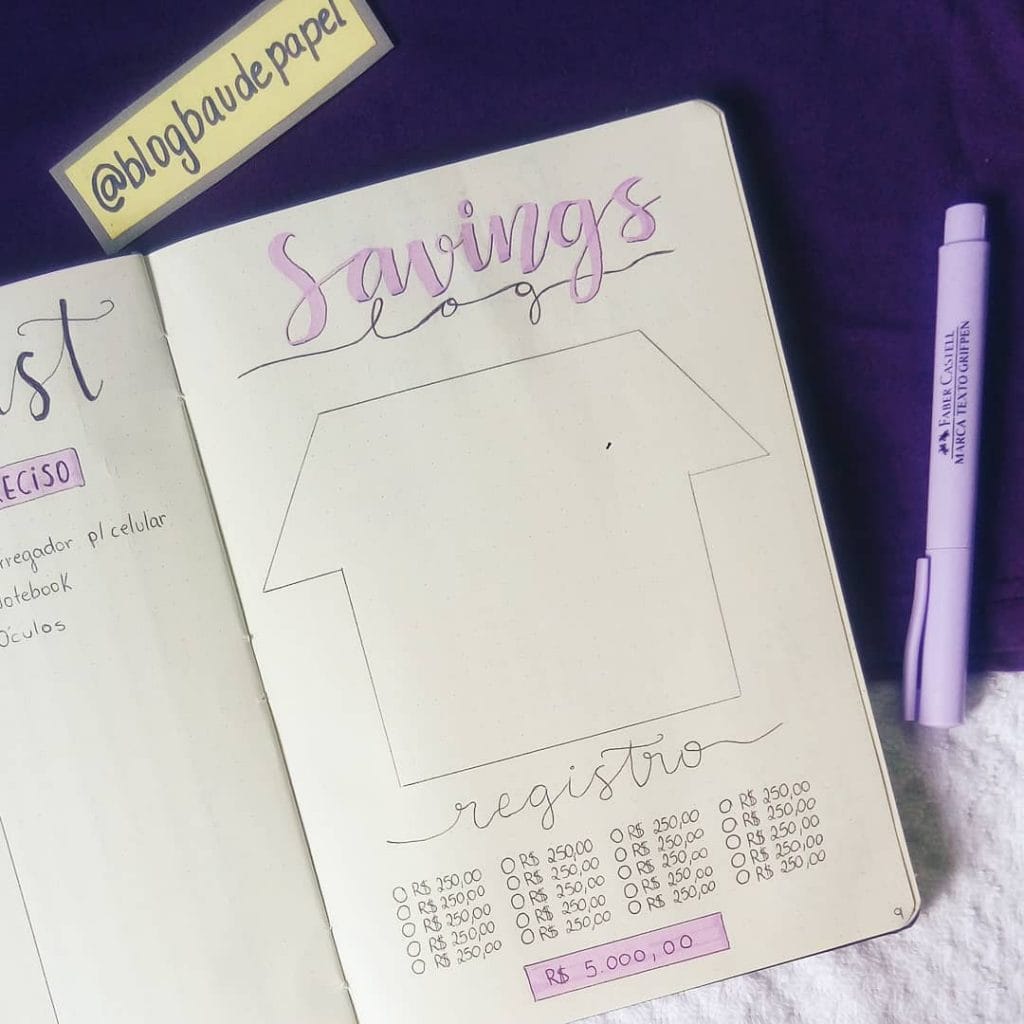

22. Bullet Journal Savings Log

If you are saving to build or buy a house, then this savings tracker layout is perfect for you. Here you have the main goal amount which is specified at the bottom of the page. This amount is broken down into smaller, achievable goals. Each time you save that amount and achieve your target, you may check it off the list and color a part of the house.

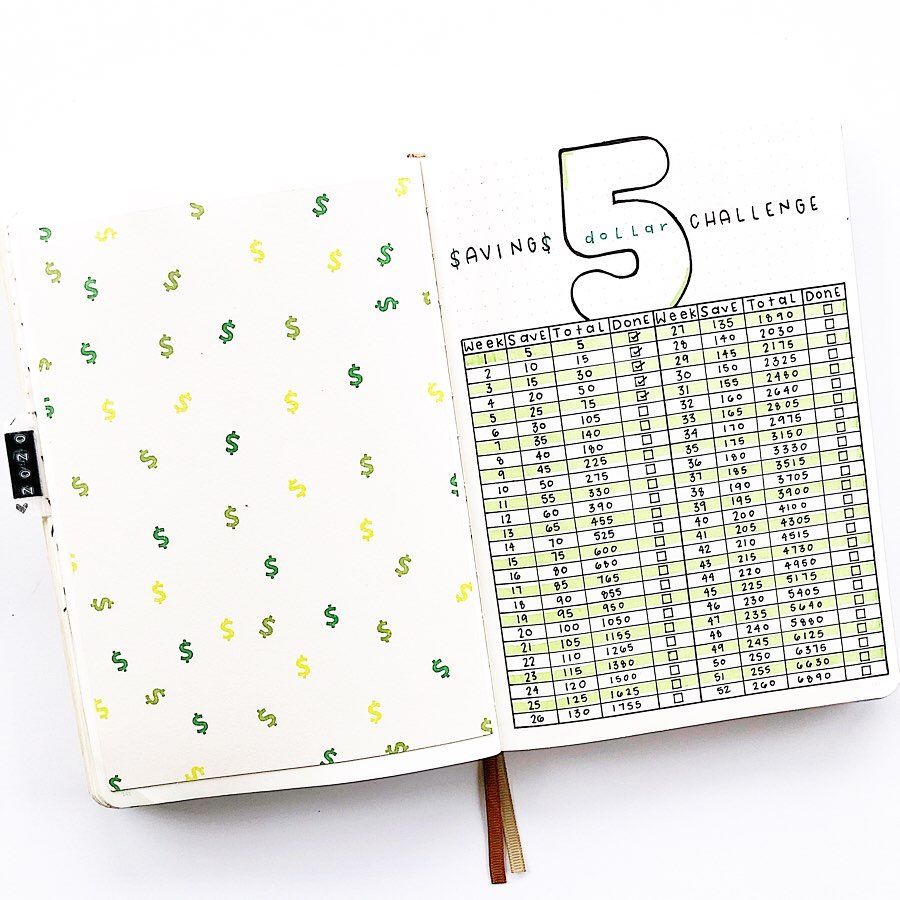

23. Bullet Journal Savings Log

Here is a great idea to save money without it feeling like a burden. Take up the five dollars a week challenge. All you have to do is save five dollars a week. Doesn’t seem like a huge amount right? But when it all adds up, you can save a significantly huge amount to achieve your financial goals. I love the dollar sign background and the easy to follow table to record your savings.

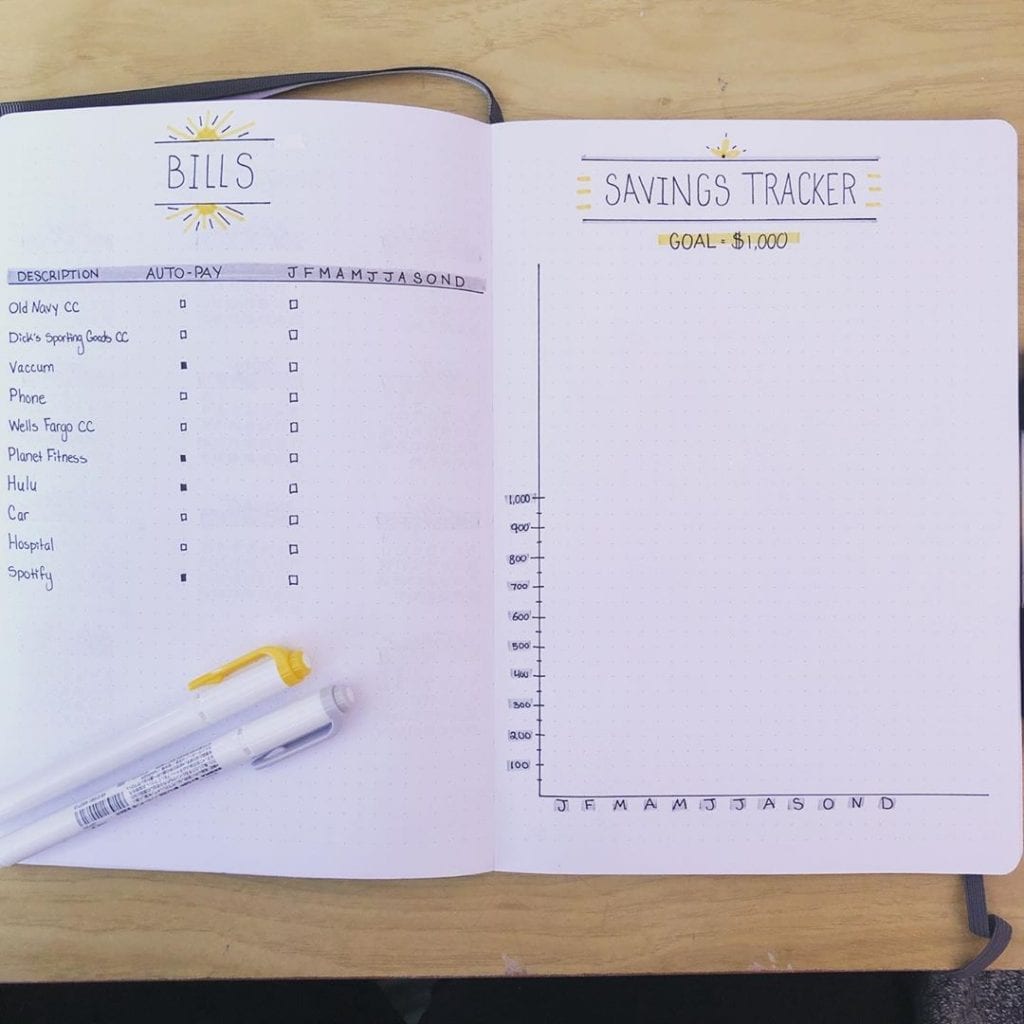

24. Bullet Journal Savings Log

Here is a bullet journal bills and savings spread. The bills tracker is like any other expense tracker we have seen above. The savings tracker, however, is quite fascinating. The savings tracker follows a graph layout. Each month you can indicate on the graph how much you have saved and at the end of the year, you’ll not only have your total savings but also a graphical representation of your saving habits.

25. The 5 Euro A Week Challenge

One way to attain your huge financial goals is by breaking it down into smaller achievable goals. Here is a 5 euro a week challenge bullet journal spread. All you have to do is add 5 euros to the pouch attached each week. Every week that you add the amount to the pouch, you also get to color-off a bill on the next page.

Voila! There you go. That was our compilation of bullet journal expense trackers, budget trackers and savings log to help you attain greater financial autonomy and make better financial decisions. Do try it out and don’t hesitate to mix different layouts and customize them according to your needs. Let us know which ones you liked the best in the comments below 🙂